Mismanaged financial records can lead to significant financial discrepancies. These discrepancies can distort financial statements and mislead stakeholders. Addressing these discrepancies promptly is crucial for financial transparency.

PropertyMetrics

- The fourth and final step is returning tenants’ security deposits according to local laws.

- Understanding their nuances is essential for accurate revenue recognition.

- Recognizing these pitfalls is the first step towards avoiding them.

- In a nutshell, it is all about expenses in relation to what you are bringing in.

- Developers and property management firms utilize accounting to plan and optimize their operations.

Anyone who decides to enter the real estate industry with the goal of investing in rental properties needs to have a professional real estate accounting system. Informed decisions are the backbone of sustainable growth in real estate. Good real estate accounting provides the data and insights needed for strategic planning. Utilizing financial forecasts, analyzing profitability ratios, and evaluating market trends are essential for making informed decisions. Transparency in real estate transactions builds trust among stakeholders.

Modern Tools of a Real Estate Accountant

By providing your tax professional with tax-ready financial statements, you’ll make their job much easier and reduce the number of billable hours they charge to you. A robust credit history separates finances, enhances credibility, and unlocks diverse financing. It offers negotiating power, limits liability, and fosters growth. Timely 4th quarter estimated tax payments are crucial to avoid penalties and maintain financial stability. Understanding criteria, accurate calculations, and prompt payments are key for individuals with irregular income. Stessa helps both novice and sophisticated investors make informed decisions about their property portfolio.

Staying Updated in the Real Estate Industry

- It emphasizes the importance of transparent financial reports, fiscal responsibility, and ethical accounting standards.

- As dividend-paying stocks, REITs are analyzed much like other stocks.

- Good real estate accounting practices include methods for documenting and showcasing these successes.

- Regular audits and reviews are crucial for REITs, given their public nature.

It’s a vital aspect of successful real estate accounting that enhances reputation. Demonstrating fiscal responsibility is key to building trust among stakeholders. Good real estate accounting practices ensure that businesses operate with financial integrity. Regular reviews, budgeting, and adherence to ethical standards are essential components.

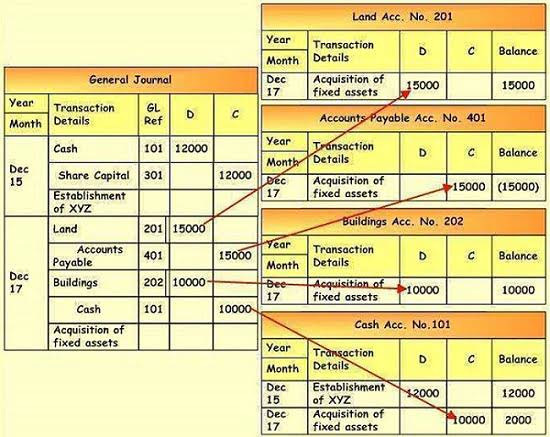

Accurate documentation of these agreements is crucial for financial clarity. Real estate accounting involves tracking every rent collection against these agreements. Advanced real estate accounting software can automate this tracking, ensuring accuracy. Regular https://www.bookstime.com/articles/accounting-for-architects reviews and reconciliations ensure that rent collections align with lease terms, ensuring financial integrity. Recognizing these correctly is crucial for accurate financial reporting. They are recorded as liabilities, reflecting the future service obligation.

- For real estate professionals, streamlined expense tracking is crucial.

- For example, if you send the tenant an invoice for the January rent in December, income is credited in December and recorded as receivable from the tenant.

- Moreover, clear financial protocols ensure that commissions are managed ethically and transparently.

- For real estate professionals, these summaries are crucial for annual planning and strategy refinement.

- Setting these protocols is crucial for consistent financial reporting.

- Regular reviews and industry trend evaluations further enhance market insights.

Accurate allocation drives business success and ensures that resources support property management objectives. Utilizing these platforms is crucial for real-time financial reporting. Advanced software solutions offer features for cloud-based real estate investor bookkeeping accounting. For real estate professionals, cloud platforms are indispensable. Accurate cloud platforms drive financial transparency and stakeholder trust. They also undertake capital expenditures to enhance property value.